What is the Recovery Rebate Credit (2025) and Are You Eligible?

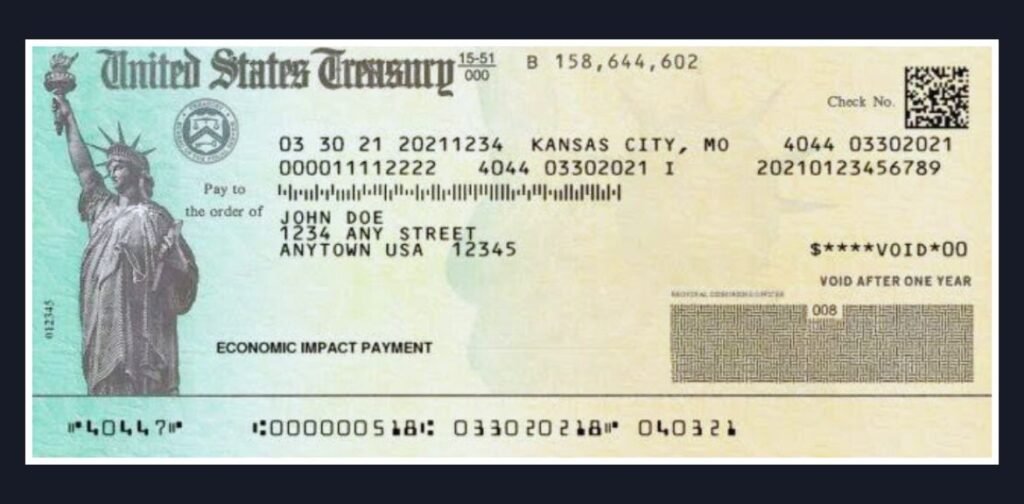

Have you missed out on a stimulus check? The IRS might still owe you some cash. Here’s how you claim it. For countless Americans, stimulus payments were a lifeline during the COVID-19 pandemic. But what if you didn’t get your full payment or maybe none at all? That’s where the Recovery Rebate Credit (2025) comes into play.

What’s the Recovery Rebate Credit?

The Recovery Rebate Credit is a refundable tax credit that lets eligible folks claim stimulus payments they missed. It first made its debut during the 2020 tax season, and it’s still important even in 2025, especially those who didn’t file taxes, moved, or saw big changes in their income.

Why You Might Still Be Eligible

If you missed any of the stimulus checks in 2020 or 2021, you could still be able to claim them now. Here are a few reasons why this might apply to you:

- You welcomed a new child in 2021 or 2022.

- You didn’t file your return on time, and the IRS couldn’t confirm your eligibility.

- You were claimed as a dependent in previous years but not in 2021.

- You faced a significant drop in income.

Is the Recovery Rebate Credit 2021 Still Relevant?

Absolutely! Many taxpayers are finding out that the IRS recovery rebate credit for 2021 was either underpaid or never issued. Even though it’s now 2025, if you haven’t filed or claimed that year’s recovery rebate tax credit, you’re still eligible, but keep in mind that the IRS refund recovery credit deadline is coming up fast.

What You Need to Do File or amend your 2021 or 2020 tax return.

- Use IRS Form 1040 or 1040-SR and fill out the Recovery Rebate Credit worksheet.

- Make sure to provide documentation—like birth certificates for any new dependents.

Just a heads up: the credit rebate recovery isn’t automatic. You need to take action to get it.

IRS Unclaimed Stimulus Payments: Time Is Running Out (2025 Update)

Didn’t get your stimulus check? You might still be owed money — but most federal deadlines have now passed, and action is only possible in limited cases.

Who’s Still Missing Out?

Millions of Americans, especially low-income earners, students, and seniors, may have missed stimulus payments from 2020 or 2021. Many didn’t realize they needed to file a return to claim the Recovery Rebate Credit.

What Can You Still Do in 2025?

- 2020 & 2021 Recovery Rebate Credit deadlines are now closed.

- 2022 tax refund claims (non-stimulus) are still open until April 15, 2026.

- Some states offered 2024 stimulus-style payments — check with your state revenue department if you think you were eligible.

How to Check

- Use the IRS “Get My Payment” tool

- Review IRS Notices 1444, 1444-B, or 1444-C

- File or amend past returns if you missed a refund (not stimulus)

Quick Tip

Filing electronically with direct deposit is the fastest way to receive any money still owed to you.

If you’re unsure, consult a tax pro. While most stimulus credits are no longer claimable, you may still qualify for other refunds or state relief.

Here’s a handy tip: filing electronically and choosing a direct deposit is the quickest way to get your refund!

How to Claim the Recovery Rebate Credit Payment in 2025

Still missing a stimulus check? You’re definitely not alone. Thousands of taxpayers across the U.S. are just now discovering that they can still claim unpaid stimulus payments by filing for the Recovery Rebate Tax Credit — even in late 2025.

If you didn’t receive your full stimulus amount from the 2020 or 2021 economic impact payments, there’s still a way to get that money — but time is running out.

Step 1: Confirm What You Actually Received

Start by reviewing your stimulus history using the IRS “Get My Payment” tool or by locating the notices the IRS mailed to you.

Look for:

- The payment amounts

- Dates of deposit or mailing

- IRS Notices 1444, 1444-B, and 1444-C (each corresponds to a stimulus round)

If there’s a difference between what you got and what you were eligible for, you might qualify for a Recovery Rebate Credit Payment Stimulus.

Step 2: File an Amended Return (If Needed)

Even if you filed your taxes for 2020 or 2021, you can still file an amended return using IRS Form 1040-X to claim the Rebate Recovery Credit.

Here’s what you’ll need:

- A copy of your original tax return

- IRS Notices for each stimulus payment

- Any supporting documents for changes (such as a new dependent, corrected income, or updated filing status)

Key Tip: Watch the IRS Recovery Rebate Credit Deadlines

Deadlines for claiming the Recovery Rebate Credit are strict — but there’s still time for many:

- 2021 Recovery Rebate Credit (based on the third stimulus payment):

You have until April 15, 2025 to file or amend your 2021 return.

As of late July 2025 — this deadline has passed. - 2022 Return (Not for Stimulus, but Still Claimable):

If you missed filing your 2022 tax return (unrelated to stimulus), the final deadline is April 15, 2026.

This is still upcoming, so you can claim a regular refund from 2022 until then. - 2020 Recovery Rebate Credit (based on the first two stimulus payments):

The deadline to claim this expired on May 17, 2024. If you missed it, you can no longer claim any unpaid 2020 stimulus funds.

So at this point in 2025, only 2022 and 2023 tax return refunds are open to recovery — and unfortunately, Recovery Rebate Credits for 2020 and 2021 are now mostly closed.

Stimulus Checks 2024 Eligibility – State-by-State Breakdown

Although the federal government did not release a new round of stimulus checks in 2024, several U.S. states independently issued financial relief to residents. These state-level payments are often confused with federal aid but have their own eligibility requirements, deadlines, and distribution methods.

Here’s a detailed breakdown of the most notable 2024 state stimulus efforts, and what to do if you missed out.

California: Middle Class Tax Refund (MCTR)

- Overview: California issued the Middle Class Tax Refund to provide financial relief for residents affected by inflation. The state distributed over $9.2 billion to approximately 32 million residents.

- Payment Amounts: Eligible individuals received between $200 and $1,050, depending on income level, tax filing status, and number of dependents.

- Eligibility Criteria:

- Filed a 2020 California tax return by October 15, 2021

- California resident for at least six months in 2020

- Not claimed as a dependent on someone else’s return

- Distribution: Payments were made via direct deposit or prepaid debit cards. As of May 2024, hundreds of thousands of prepaid cards remained unclaimed, totaling over $125 million (Los Angeles Times, California Franchise Tax Board).

- Important Dates: Debit cards must be activated and used by April 30, 2026.

New Mexico: Income Tax Rebate (2023, Not 2024)

- Recent Update: Despite rumors, New Mexico has not approved a 2024 tax rebate as of mid-2025. The last official rebate was issued in 2023.

- Prior Relief (2023):

- $500 for single filers

- $1,000 for joint filers

- Payments were automatic for those who filed 2021 tax returns by May 2023

- Clarification: The New Mexico Taxation and Revenue Department confirmed in May 2025 that there is no rebate currently tied to 2024 tax returns (FingerLakes1).

Maine: Winter Energy Relief Payment

- Program Details: Maine issued one-time $450 payments in early 2023 to help residents offset winter heating and energy costs.

- Eligibility Requirements:

- Full-year resident of Maine in 2021

- Filed a 2021 state income tax return by October 31, 2022

- Income threshold: $100,000 for single filers, $150,000 for heads of household, and $200,000 for joint filers

- Distribution: Checks were mailed automatically between January and March 2023. No additional action was required by eligible recipients (Maine.gov).

Idaho: Tax Rebate Program

- Details: Idaho offered two types of rebates based on tax returns filed for 2020 and 2021.

- Amounts:

- The greater of $75 per taxpayer and dependent, or 12% of Idaho state taxes paid

- Later rebates included flat amounts ($300 single / $600 joint)

- Eligibility: Full-year Idaho resident who filed state income taxes by a specified date (Idaho State Tax Commission).

South Carolina: Refund Payments

- Overview: South Carolina issued income tax rebates to residents who filed a 2021 return by the October 2022 deadline.

- Amounts: Up to $700, based on the individual’s 2021 state tax liability

- Eligibility: Residents who owed taxes in 2021 were eligible for partial or full rebates (South Carolina Department of Revenue).

What to Do If You Missed Out

If you didn’t receive a payment but believe you were eligible, here are a few steps you can take:

- Check your state’s tax website for refund tracking tools or payment status portals.

- File or amend your tax return if you missed the original deadline. Some states offer a “rebate recovery” mechanism.

- Claim or activate payment cards: In California, over 600,000 debit cards from the MCTR program remain unactivated, and funds could expire if left unused.

- Watch for new legislation: Some states consider additional rebates based on economic conditions or budget surpluses.

Though the federal government has not provided a new round of stimulus checks since early 2021, multiple states have taken independent action to support their residents through targeted tax rebates and relief programs. These payments vary widely in structure and eligibility, making it crucial for taxpayers to stay informed through their state’s official tax authority or treasury website.

If you believe you may have qualified for one of these programs, it’s worth checking your state’s refund status or contacting your state tax office to explore possible next steps.

Avoid These Common Mistakes When Claiming the Recovery Rebate Credit

Claiming your IRS Recovery Rebate Credit isn’t as difficult as it may sound, but there are a few common missteps that can delay your refund or even cause your claim to be denied.

Even the most diligent taxpayers can make these errors, especially when dealing with multiple stimulus rounds and changing tax rules. Let’s walk through the most frequent mistakes and how to avoid them.

Mistake #1: Not Reviewing IRS Notices Carefully

Before you file anything, take a moment to check the notices the IRS sent you after each stimulus payment. These are labeled Notice 1444, 1444-B, and 1444-C, and they explain exactly how much money was issued and when.

Many people claim a credit because they think they didn’t receive a payment — when in fact, the IRS already sent it. Reviewing these notices helps you avoid duplicate claims and keeps your return from getting flagged.

Mistake #2: Claiming a Dependent Who Was Already Claimed

This one trips up a lot of families.

Let’s say your child was claimed by the other parent in 2020, but you want to claim them in 2021. Or maybe a grandparent claimed your niece during the pandemic. The IRS doesn’t allow multiple people to claim the same dependent for the same year.

Before you submit your return, double-check who claimed whom in previous years. A simple conversation with family or a former spouse can save you a big headache later on.

Mistake #3: Filing Under the Wrong Tax Year

The Recovery Rebate Credit is tied directly to the year the stimulus was issued.

That means:

- The 2020 stimulus payments (the first and second rounds) must be claimed on your 2020 tax return

- The 2021 stimulus payment (the third round) must be claimed on your 2021 tax return

We’ve seen many clients mistakenly try to claim a missed 2020 payment on their 2021 return, which leads to confusion, processing delays, and sometimes outright denial.

Make sure you’re using the correct year’s return for the credit you’re trying to claim.

Mistake #4: Missing the Filing Deadlines

Time is running out.

Although we’re now in 2025, there’s still a narrow window to file or amend past tax returns to claim any missed recovery rebate tax credits. But deadlines are strict.

- For the 2020 Recovery Rebate Credit, the deadline to file is May 17, 2024

- For the 2021 Recovery Rebate Credit, the deadline is April 15, 2025

Once those dates pass, you can’t go back and claim the credit. It doesn’t matter how legitimate your case is, the IRS won’t process late claims for past years. So if you’re still missing money from those payments, act now.

Final Takeaway

Still unsure about your stimulus payments or the recovery rebate credit? You could be leaving money on the table. Don’t wait until it’s too late — talk to us, Sepiolite, a trusted tax pro & bookkeeper who can help you get what you’re owed. A quick review could mean hundreds back in your pocket.